Note: This blog was originally published in 2021. It was updated in January, 2024 to reflect the most recent information. If you have any questions, please contact us.

Commercial solar is something of an enigma. Falling between the better-known residential and utility-scale solar industry sectors, commercial solar — or C&I solar as it’s often called, referring to commercial and industrial scale — encompasses a wide variety of customer types, and project sizes.

As Ian Clover, Manager of Corporate Communications for Hanwha Q Cells, explains, “In the jargon-heavy world of solar-speak, C&I handily condenses Commercial and Industrial into a snackable sub-section of the PV industry. But as subsections go, the C&I space has perhaps the greatest scope for flexibility, offering a raft of possibilities from ground-mount through to ingenious use of rooftop space.”

What this article covers

For a variety of reasons we’ll touch upon in this article, commercial solar has been slow to take off, but there are signs that this sector is poised for significant growth. And, for those who learn to navigate the complexity of these projects, the rewards can be big.

This article is part of a series on commercial solar. In today’s article, we’ll dive into what commercial solar is, the challenges that have limited its growth, and predictions for its future expansion.

In other articles, we discuss the different players involved in commercial solar projects and how to sell a commercial solar project, and some of the financing structures for commercial solar projects.

What is commercial solar?

Commercial solar differs from residential solar in a number of key ways.Commercial solar encompasses a variety of different types of customers and projects. In addition to businesses of different sizes, from large corporations to local small businesses, “commercial” solar customers can also include governments, schools and universities, and even nonprofits.

Commercial solar projects may take the form of rooftop arrays on buildings or ground mounts and can range widely in size from kilowatts to megawatts. According to Joe Naroditsky, Director, Solar & Operations at the Community Purchasing Alliance (CPA), an organization that connects nonprofits with solar bids, the C&I solar projects his organization facilitates can range in size from 50 kilowatts (kW) for small churches and synagogues to 300-400 kW for large schools.

And that’s just the tip of the iceberg.

Commercial solar opportunities

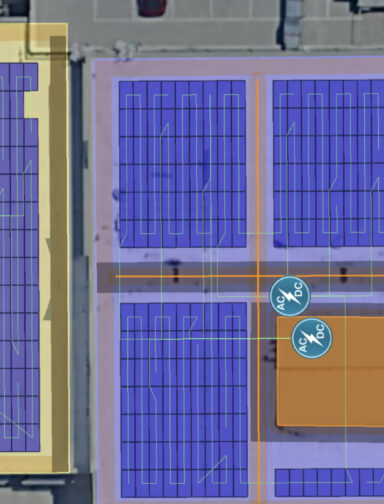

With the help of Aurora Solar software, researchers at UC Davis have examined the real-world solar potential of some of the largest commercial buildings in the United States.

Their review of the largest commercial building in the U.S., a Texas-based aerospace company with 770,000 square meters of rooftop, found that it could generate 88 million kilowatt hours (kWh) of clean energy! As explained in the Washington Post, “That’s enough to power nearly 5,200 homes for a year, offset 47,800 metric tons of CO2, and spare up to 388 acres of land.”

Obviously, this is the extreme end of the spectrum, where building rooftops rival the scale of utility-scale projects. However, it serves to illustrate the variation in potential project sizes in a sector where the buildings and customers differ widely.

Constraints on the commercial solar market

Several constraints collectively contribute to a slower adoption rate of solar energy in the commercial sector. Let’s explore how upfront costs and complexity of projects remain significant barriers.

Cost of commercial electricity vs. residential

There are a number of factors that have contributed to C&I lagging behind residential solar. For one, commercial electricity prices are historically lower, which can make the economics of solar a little trickier.

According to the U.S. Energy Information Administration, in July 2023, the average cost of electricity for U.S. residential customers was 15.9113.3 cents per kilowatt hour (kWh), while the cost for commercial customers was 13,1111.9 cents per kWh.

In addition to lower commercial electricity prices, a Q3 solar market insights report by SEIA explains: “Costs have remained high in 2023 as labnor and balance of systems costs have increased. Components such as modules and inverters are up 5% to 20% year-over-year for the commercial and utility segments.”

Convincing building owners to purchase

Another barrier relates to the fact that in many commercial buildings, the occupant is not the building owner. This “split incentive” means that the building owners who would make the decision to install solar are often not the ones paying the utility bills, making solar energy savings less of an incentive for them.

Complex commercial financing

Financing is also more complex in the C&I solar space and, according to some contractors we’ve spoken with, less accessible. However, that is beginning to change as financing mechanisms for this space become better understood by financial actors, and there are more successful projects for financiers to look at to assess risk.

Financial viability was the first major hurdle in solar sales, as any solar installer knows. Commercial solar systems were therefore a trickier sell.

However, one of the major things easing financing is the options now available to consumers for commercial solar financing. There are now a variety of ways that businesses can pursue their solar projects, one option being power of purchase agreements (PPAs). These allow investors to take on the pressure of large upfront commercial solar costs, allowing consumers to pay off the system a little bit at a time.

Other barriers

Other barriers include, “contracting challenges, the mismatch in building lease and PV financing terms, and high transaction costs relative to project sizes,” according to a National Renewable Energy Laboratory (NREL) report.

Solutions to commercial solar barriers

Many of the challenges in this sector are already being surmounted. A white paper by the Solar Energy Industries Association (SEIA) and SolarKal highlights the fact that commercial solar projects can be structured in a variety of ways that split the costs and benefits across building owners and tenants to meet different criteria. They also emphasize the variety of financing structures available to fit the needs of the parties involved and the fact that solar is cost-competitive with utility energy.

As discussed above, commercial PPAs are a great option for small businesses and nonprofits that want the benefits of solar but are unable to cover the upfront costs — despite the fact that the upfront cost is often almost negligible considering the offset of reduced energy bills.

Potential for growth in commercial solar

The growth of the commercial solar sector varies by region and market conditions. According to Wood Mackenzie, the global solar market, including commercial solar, is entering a phase of slower growth as it matures. While the sector will continue to grow, the rate of growth may be decelerating compared to previous years.

However, this doesn’t necessarily indicate a decline in the sector’s overall potential or health. Deloitte Insights reports that renewable deployment, including solar, is expected to grow by 17% to 42 GW in 2024 in the United States, indicating continued expansion in the sector.

SEIA estimates “long term growth will gradually increase due to the IRA and higher electricity rates. We expect 1,731 MWdc to come online nationally this year and to grow to 2,500 MWdc by 2028.”

While the rate of growth in commercial solar might be decelerating as the market matures, the sector will continue to expand. This deceleration is a typical characteristic of a maturing market. The solar industry’s overall health and future potential remain robust, supported by policy incentives, technological advances, and increasing demand for renewable energy.

Commercial solar benefits

Commercial solar offers a blend of economic, environmental, and social benefits, making it an increasingly attractive option for businesses of all sizes.

For building owners, benefits include increased operating income and cash flow and longer lease terms, as the SEIA/SolarKal white paper notes.

For tenants, reduced operating costs through utility bill savings are an obvious and very real benefit.

Of course, there are also benefits for solar contractors that successfully navigate this sector. Commercial solar projects are often a tough sell, but they can have a great impact on overall numbers for solar companies.

The economies of scale at play in these larger projects can make them more lucrative, and that’s on top of the significantly larger total project price tags compared to residential projects.

Be sure to check out the other articles in this series to learn more about the ins and outs of the C&I space. Whether you’re already actively involved in commercial solar, are interested in transitioning into this space, or just want to increase your understanding of the industry, our goal with this series is to provide helpful perspectives on how the commercial solar sector works.

In our other posts, we’ve delved into the various players involved in commercial projects, how to sell C&I solar projects, and some of the financing structures for commercial solar projects.

We’re excited about the potential of C&I solar as another key pillar in the growth of solar energy more broadly and hope you are, too!

FAQs

Should I sell solar to businesses?

Whether you already sell solar on a different scale or are looking for a new venture entirely, commercial solar is a growing industry with opportunities to create value in many unique ways. While there are many challenges and obstacles that exist in commercial solar, selling solar panels to businesses can be worth it with the right tools, resources, and initiative.

Is commercial solar profitable?

Yes and no, commercial solar can be profitable, but only if performed with careful execution. When considering the resources and scale necessary to sell commercial solar, profitability can be most consistently achieved with low business overhead costs, minimal design changes, and thoughtful client pricing on each new project.

How can I find commercial solar clients?

Like painting a picture, there is no “wrong way” to find commercial solar clients, but there are a few tried and true methods that can pave a path to success. While maximizing the use of your time and resources, putting yourself “out there” as much as you can (online, at trade shows, etc.) can lead to more conversations, referrals, and ultimately more clients.

How do commercial solar agreements work?

Commercial solar panel agreements can work in a variety of ways to best fit the needs of the building owner, tenant, or other involved parties. As a commercial solar developer, it is your job to educate your clients about the different types of agreements (ownership, lease, PPA, etc.), and weigh each structure’s pros and cons to find the best solution for every unique project.

How do I get started selling commercial solar?

There are many ways to start a solar business, and selling commercial systems can be a pretty significant undertaking. If you are up for the task, a few key things you will need to get started include: a business license, high-quality commercial solar design software, and the personnel or network to execute each stage of the installation process.

Want to learn more? Schedule a quick chat to get all your questions answered.