Sales is all about converting leads into paying customers, and doing it quickly. This is especially true in a competitive market like solar, where even the smallest delay can mean losing the sale to a more flexible competitor.

At the same time, solar is an especially tough business to close deals quickly. Solar sales reps generally need to guide homeowners through a bunch of steps, using a bunch of different software systems.

So how can you cut down all this software bloat and streamline the process, making it less confusing for customers, and enabling your reps to close more deals?

Since speed is of the essence in sales, this blog will give you one big way to streamline your sales process in less than two-minutes of reading time.

The Financing Problem

Financing is one of the most complex things about a solar sale. If you’re like most installers you’ve dealt with it in one of two ways:

- You’ve used Aurora, but you and your homeowners have had to jump through many hoops to finance the system by using and signing into multiple accounts and portals

- You’ve tried to solve the problem by turning to less accurate Aurora competitors that having financing integrated into their product

Integrated Financing!

Well, say goodbye to this Sophie’s choice.

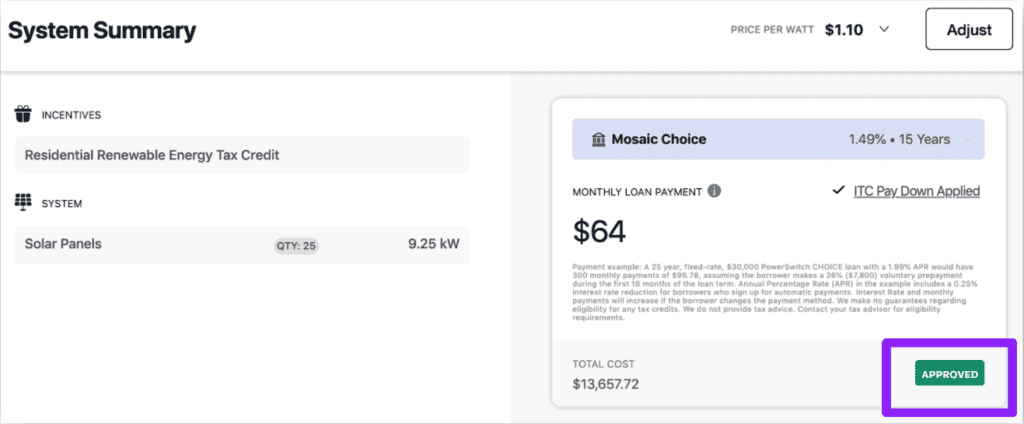

Aurora now has financing options directly integrated into Sales Mode, with Mosaic as a partner. This lets reps streamline loan pre-approval and documentation — for themselves and customers. How? We’re approaching a minute, so we’ll keep it quick.

Aurora now has financing options directly integrated into Sales Mode, with Mosaic as a partner. This lets reps streamline loan pre-approval and documentation — for themselves and customers. How? We’re approaching a minute, so we’ll keep it quick.

With Aurora’s Integrated Financing, your reps can:

- Share side-by-side bill comparisons and apply for financing directly in Aurora, with the customer right there

- Close deals faster by cutting down on the number of systems needed for customers to apply for financing

- Reduce change orders and cancellations by getting rid of the error-prone manual data entry contracts usually require (and often has to be entered multiple times into multiple systems)

- Get that one-call close by reviewing multiple pay-off scenarios in real-time with accurate, updated loan information

- Close customers on the spot with automated document generation and integrated e-signature options

This, of course, just scratches the surface of how Integrated Financing can help your reps simplify the customer experience, achieve higher close rates, and ultimately generate more revenue. But, we promised you a two-minute read, so we’ll just answer the final question:

How do you get Integrated Financing?

Integrated Financing is included in every New Aurora and Sales Mode contract or subscription — all customers based in the US doing residential projects have access to it.

You can also use Integrated Financing with with some of our other solutions:

- Web Proposal: This free feature lets you accurately show customers their loan and loan terms in their web proposal; this way, the customer can review the loan terms on their time while they consider the contract

- Contract Manager: Automatically add financing terms directly to the contract, and then close the deal on the spot with e-signature capabilities (premium)

To learn how to configure your Integrated Financing, see these (brief) step-by-step instructions. Current Aurora customers can activate Integrated Financing by going to the Integrations page in your Aurora settings.

We’re at the end of our time, but to learn more, watch our Sales Mode and Contract Manager webinar, visit our Sales Mode site, and then get in touch for a quick demo.

We really think Integrated Financing will streamline your sales processes and ultimately lead to your reps closing more deals, more quickly. Give it a try and let us know if we’re right.